Are you looking for an easier way to save money and stay on top of your bills?

You’re not alone.

Many people want to feel more in control of their money, but the budgeting process can feel like too much work.

The great thing is, it doesn’t have to be.

That’s why I’ve created a collection of free and easy budgeting printables—just for you.

Whether you're trying to cut back on spending, pay off debt, or plan ahead for car repairs, these 10 free budget worksheets will help you make better financial decisions.

Get them today! Instant downloads.

- Simple Monthly Budget Planner

- Weekly Spending Tracker

- Budget Binder Cover + Divider Pages

- Bill Payment Checklist

- Debt Payoff Worksheet

- Savings Goals Chart

- Monthly Budget Calendar

- Expense Category Breakdown Worksheet

- Budget Review & Reflection Page

- Annual Budget Summary

- Conclusion

- Learn More / Sources

(1) Simple Monthly Budget PLANNER

Even if this is your first month trying a budget, these tools are made for beginners and busy people alike.

Each printable helps you organize your personal finances, one small step at a time. You’ll be able to track your actual income, manage monthly expenses, and spot spending habits that need a little work. And the best part?

They’re completely free for personal use—no fancy apps, no subscriptions, and no stress.

Just download a printable and grab a pen.

If you’re just starting out with budgeting, this Simple Monthly Budget Planner is one of the best ways to take control of your finances and save money.

It breaks down your actual income and monthly expenses into clear sections, so you can easily see where your money is going.

Start by writing in how much money you bring in for the month. Next, list your bills, like rent, groceries, car payment, and other regular expenses.

You’ll also track things that change each month, like gas or shopping.

This planner helps you spot spending habits that are costing you more than they should.

At the end of the month, you can compare what you planned to spend with what you actually spent.

That’s how small changes—like eating out less or canceling a service provider you don’t use—can lead to big savings.

This printable is a great foundation template.

Use it every month to make better financial decisions and build toward your long-term financial goals.

(2) Weekly Spending Tracker

The Weekly Spending Tracker is one of the easiest ways to take a closer look at your day-to-day spending—and it can help you save money fast.

Instead of tracking everything once a month, this printable lets you write down each expense as it happens.

From that morning coffee to a last-minute online order, it all adds up.

You can divide your spending into categories like food, gas, personal care, and entertainment.

At the end of the week, total up each category. This will help you spot problem areas and plan better for the following month.

By seeing your daily expenses on paper, you’ll be more aware of your spending habits and more likely to make smart choices.

This tracker is a simple tool, but it plays a big role in helping you improve your personal finances.

(3) Budget Binder Cover + Divider Pages

Sometimes the hardest part of budgeting is keeping everything in one place.

That’s where the Budget Binder Cover and Divider Pages come in.

This printable set helps you stay neat, organized, and motivated—all in one binder.

The binder and cover page give your budgeting system a home, and the divider pages let you split it into helpful sections like:

Monthly Budget

Savings Goals

Debt Payoff

Receipts and Notes

DIVIDER PAGES

Having a place for everything keeps your budgeting process stress-free and helps you stay focused on your financial goals.

When everything is organized, it’s easier to stick with it—and that’s how you save more money month after month.

If you want to see your progress in one spot, this binder setup is for you. Use it for your family budget or just for personal use.

(4) Bill Payment Checklist

Late fees are one of the easiest ways to waste money.

That’s why this Bill Payment Checklist is a must-have.

It helps you keep track of all your regular bills—like rent, utilities, phone, internet, and subscriptions—so you can pay them on time, every time.

The checklist has a simple layout. You write down each bill and check it off once it’s paid.

It’s a great way to see what you need to pay monthly and what’s already taken care of.

Knowing your bills are covered gives you peace of mind and protects your credit score. You’ll avoid late charges, reduce stress, and stay in control of your finances.

💡 Want to Save Time?

All 10 budgeting worksheets on this page are available as free individual downloads. But if you'd prefer to save time and get them all in one neat bundle, you can download the full Budget Binder PDF Pack .

- ✔️ All 10 printable budget worksheets PLUS bonus pages

- ✔️ Binder cover page (Your Choice! Colorful or Printer-Friendly)

- ✔️ Quick-start overview sheet

Everything you need to start budgeting—in one click.

Click here to get the Complete Budget Binder Pack!(5) Debt Payoff Worksheet

Debt can feel overwhelming, but you don’t have to tackle it all at once. This Debt Payoff Worksheet helps you make a clear plan to pay off what you owe, little by little.

And the best part? It can help you save money by avoiding interest and late fees.

With this printable, you’ll list each debt: credit cards, loans, car payments, or medical bills.

Then you’ll write down the balance, due date, interest rate, and minimum payment.

You can also track how much you paid this month and how much is left to go.

Seeing your progress on paper can keep you motivated. It’s a powerful way to build your credit score and improve your financial health.

Whether you’re using the snowball method (smallest debt first) or the avalanche method (highest interest first), this worksheet makes it simple.

(6) Savings Goals Chart

Saving money is easier when you can see your progress.

That’s what makes this Savings Goals Chart so powerful.

It helps you turn your dreams—like a vacation, emergency fund, or car repairs—into specific goals you can reach one dollar at a time.

This printable lets you set your total savings goal and break it into smaller steps.

For example, if you want to save $600, you might divide it into 12 steps of $50 each.

Every time you hit a step, color it in or give it a check mark!

It's a fun way to stay on track.

You can use this chart for short-term goals, like back-to-school shopping, or long-term ones, like building your emergency fund.

It’s great for college students, parents, and anyone who wants to build financial stability.

When you write your goal down and track it, you’re more likely to follow through—and that’s one of the best ways to save more money.

(7) Monthly Budget Calendar

One of the easiest ways to save money is by knowing exactly when money comes in and when bills go out.

This Monthly Budget Calendar helps you see your financial month at a glance so you never miss a payment again.

This Monthly Budget Calendar helps you see your financial month at a glance so you never miss a payment again.

Use this printable to mark your payday, bill due dates, automatic payments, and other important money events.

You can even use colored pens or stickers to show different types of expenses like rent, groceries, and credit card payments.

This tool is perfect if you’ve ever forgotten to pay a bill or overspent before payday. When you can see your full month laid out, you make better financial decisions and stay in control of your finances.

The calendar is also great for planning ahead.

You’ll know how much money to set aside for big things like holidays, school supplies, or even car repairs.

(8) Expense Category Breakdown WORKSheet

This Expense Category Breakdown Sheet helps you find out where your money is really going—and how to spend smarter.

This printable lets you divide your monthly expenses into main categories like housing, food, transportation, health, and fun.

At the end of the month, write how much you planned to spend and how much you actually spent in each area.

By comparing these amounts, you’ll spot the categories where you may be overspending.

Maybe your controllable expenses—like takeout or entertainment—are higher than you thought. That’s where you can cut back and save money without giving up what you need.

This sheet is a great way to get honest with yourself about your spending habits. Use it every month to make sure your total budget stays on track.

(9) Budget Review & Reflection Page

Saving money isn’t just about tracking numbers—it’s also about learning from them.

This Budget Review & Reflection Page gives you a chance to stop, think, and plan for the following month.

At the end of each month, use this printable to answer a few simple questions:

What went well?

Where did I overspend?

What did I learn about my spending habits?

What can I do better next month?

You’ll also review your actual income, total expenses, and any money saved.

Taking time to reflect helps you understand your spending habits and make stronger financial decisions in the future.

This page works well with any budgeting method and is a great way to build financial stability over time.

Even a little bit of reflection can go a long way. Use it to set specific goals and stay focused.

(10) Annual Budget Summary

Want to see the big picture?

The Annual Budget Summary helps you track your money month by month, so you can find patterns, set new goals, and save more in the future.

This printable lets you record your actual income, monthly expenses, total savings, and key wins for each month of the year.

It’s a great tool for understanding how your personal finances change over time—and how small improvements can add up to big results.

Use this sheet to plan for major changes, like home repairs, family vacations, or even investing.

By reviewing your total budget for the year, you’ll be able to make stronger financial decisions and set smart investment objectives.

The more you know about your past money habits, the better prepared you’ll be to grow your savings and reach your long-term financial goals.

And that means real financial stability—one month at a time.

Stress-Free Organization

Colorful or Printer-Friendly

Helps You Focus

Budgeting Saves Money!

CONCLUSION

Managing your money doesn’t have to be hard. When you have the right tools, you can take control of your finances, make smart choices, and save money.

In this article, you discovered 10 free and easy budgeting printables worksheets to help you track spending, pay off debt, plan savings, and stay on top of your bills.

Whether you’re building a family budget, living on a tight income, or just want to improve your financial health, there’s a printable here for you.

Start simple. Pick one or two printables to try this week.

Add more as you go. The great thing is, these tools are flexible, free, and made for real life.

Each small step you take brings you closer to your financial goals.

Zero-Based Budgeting Explained: A Beginner's Guide

Have you ever reached the end of the month and wondered, “Where did all my money go?”

You are not alone.

Many people struggle with managing their monthly income and keeping up with monthly expenses.

It’s easy to lose track of spending, especially when unexpected costs pop up.

That’s where zero-based budgeting comes in.

In this guide, you’ll learn how zero-based budgeting works and why it’s a great way to manage your finances.

(1) What is zero-based budgeting?

Zero-based budgeting, or ZBB for short, is a simple but powerful way to take full control of your finances.

This budgeting method helps you to stay focused on your financial goals so you’re not wasting money.

ZERO-BASED BUDGETING IS A GREAT WAY FOR INDIVIDUALS AND FAMILIES TO MANAGE THEIR PERSONAL FINANCES.

Instead of guessing how much you’ll spend or relying on last month’s budget, ZBB starts fresh every month. Every dollar of your income is assigned a job before the month begins. That way, nothing is left unplanned.

With zero-based budgeting, your monthly income minus your monthly expenses equals zero dollars. But that doesn’t mean you spend all your money!

It means every dollar is put to good use, whether for essential expenses, debt repayment, or savings goals.

If you’ve struggled with budgeting in the past or want a better way to reach your long-term goals, zero-based budgeting can help.

It’s a popular approach because it’s simple, effective, and flexible—no matter your financial situation.

(2) ZERO-BASED BUDGETING for Families and Small Businesses

Many families feel like their money disappears faster than they expected.

Bills, groceries, gas, and other monthly expenses can pile up before you even realize it.

If you’re tired of feeling like your money is running your life, there’s good news. There’s a budgeting method that can help you.

Large organizations, small businesses, and regular families like yours use the ZBB method.

So, how can it help you?

With zero-based budgeting, you create a brand new plan each month. You base the plan on what you actually earn and need, not just on what you spent last month.

Using zero-based budgeting is especially helpful if your income changes from month to month. This is true for families with hourly jobs, self-employment, or a side hustle.

If you’re running a small business or a side hustle, ZBB helps you stay lean and focused.

You only spend money on the things that matter most for your customers and your goals. Instead of copying your previous year’s budget, you ask, “What do we need right now?”

This approach helps you make smarter financial decisions that lead to cost savings and growth.

For families, it helps you to avoid overspending and to build better spending habits.

By giving every dollar a job—from groceries to savings to debt repayment—you can stop worrying about where your money went and start telling it where to go.

Whether you’re managing a household or a small shop, ZBB gives you the tools to build a plan with purpose—and the confidence to stick with it.

No matter your situation, with Zero-Based Budgeting, you’ll be better prepared for unexpected expenses.

Now that you know how powerful zero-based budgeting (ZBB) can be for both families and small businesses, you might be wondering, “What do I do next?”

It’s one thing to understand the benefits—it’s another to put them into action.

That’s where the real magic of ZBB begins. This budgeting method is a simple system that can help you take control of your finances in everyday life.

When you follow it step by step, you’ll see how easy it is to give every dollar of income a job.

You don’t need a finance degree, expensive software, or even a perfect income stream.

All you need is a little time, honesty, and a willingness to look closely at your monthly income and monthly expenses.

ZBB gives you a starting point that fits your real situation, not what you wish you earned, or what you spent last year.

It helps you face your spending habits head-on and decide what truly matters to you and your family.

Best of all, it’s flexible.

Whether your income is steady or inconsistent, ZBB helps you build a plan that works for you.

In the next section, you’ll learn the exact steps to create a zero-based budget.

We’ll break it down into easy pieces so you can start right away. Once you learn the process, you’ll be ready to take full control of your personal finances—one dollar at a time.

(3) How Zero-Based Budgeting Works (Step-By-Step)

Now that you know what zero-based budgeting (ZBB) is, let’s walk through the step-by-step process.

By following these steps, you’ll gain better control over your personal finances and know that every dollar of income has a purpose.

Step 1: Add Up Your Monthly Income

The first step in creating a zero-based budget is knowing exactly how much money you have. This includes:

Your regular paycheck after taxes

Side hustle income (like babysitting, freelancing, or selling items online)

Other sources of money, such as government benefits, child support, or gifts

For example, if you earn $3,500 per month from your job and $500 from a side hustle, your total income for the month is $4,000. This is your starting point for creating a new budget.

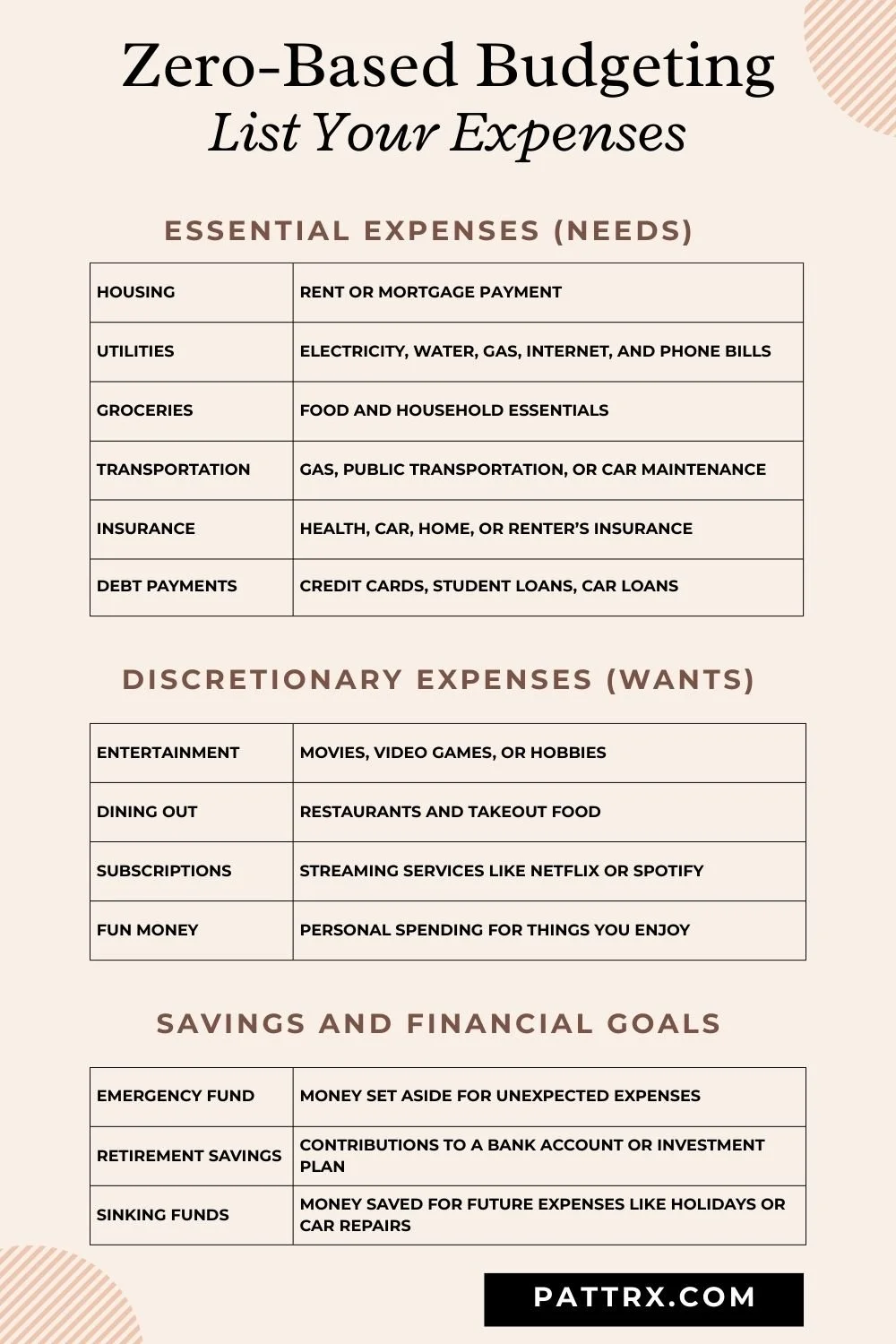

Step 2: List All Your Monthly Expenses

Next, make a list of everything you spend money on in a single month. Your monthly expenses should be divided into categories:

Step 3: Give Every Dollar a Job

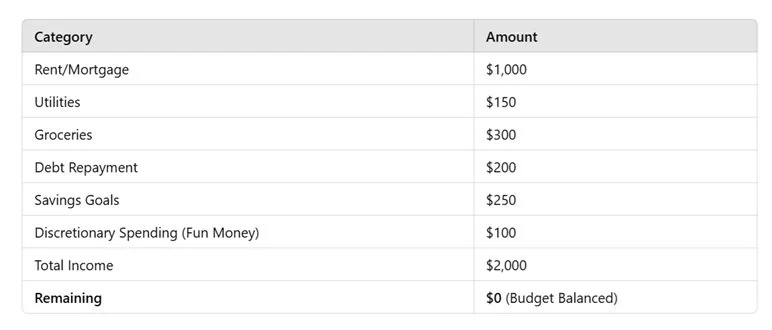

Once you have listed your monthly expenses, the next step is to match them to your income. The goal of zero-based budgeting is to allocate every dollar so that total income – total expenses = zero dollars.

Here’s an example:

In this case, the zero-based budget work is complete—every dollar has a job! Total income was $2,000, and expenses and savings totaled $2,000.

Step 4: Track and Adjust Your Spending

Throughout the month, track your spending using, for example, a free budgeting app from GoodBudget, a notebook, or a spreadsheet.

If you spend more in one budget category, you must lower costs in another to keep your budget balanced.

Step 5: Prepare for Irregular Expenses

Not all expenses happen every month. To avoid surprise costs, save a little each month for things like:

Car repairs

Annual insurance payments

Holiday gifts

This ensures that you won’t have to use credit cards or dip into your emergency fund when these expenses come up.

(4) Conclusion

Instead of wondering where your money went, you’ll start telling it where to go—on purpose.

Are you a busy parent, a business owner, or just trying to stretch your paycheck? This method gives you a clear, simple way to make every dollar count.

You’ll create a new plan each month based on your actual income and needs.

Zero-based budgeting helps you stay focused and flexible.

Starting a zero-based budget may feel like a big change.

Still, it’s one of the smartest steps you can take to get control of your money.

It can guide you through tough times, prepare you for unexpected expenses, and help you reach goals like paying off debt or building an emergency fund.

Best of all, it works even if your income changes from month to month or if you’re new to budgeting.

And if you’re a beginner, it reassures you that you don’t need a perfect financial situation to start taking control of your money.

Now that you’ve learned the basics of how zero-based budgeting works, it’s time to take your knowledge a step further.

In the next part of this guide, “Use Zero-Based Budgeting to Save More and Spend Smarter,” we’ll explore how to save more, spend smarter, and overcome common challenges of zero-based budgeting.

Get ready to strengthen your financial confidence and make zero-based budgeting a habit you can stick with for life.

LEARN MORE / SOURCES

Bibliography / Sources

Investopedia – Zero-Based Budgeting (ZBB) Definition, How It Works, and Examples

Investopedia – Advantages and Disadvantages of Zero-Based Budgeting

Wall Street Mojo – Traditional Budgeting vs. Zero-Based Budgeting

PLANERGY – Pros and Cons of Zero-Based Budgeting

LendingTree – How to Use the Envelope Budgeting System

Actual Budget – Envelope Budgeting Overview

50 Tips for College Students with Limited Funds

In this article, I’ll give you 50 tips to help you and the students in your life manage their money wisely so college life can be both enjoyable and financially secure.

Read moreFinancial Goal Setting for High School Students

Financial literacy is a cornerstone of responsible adulthood in today's rapidly evolving economic landscape, yet it remains a skill often underrepresented in traditional high school curricula.

Read more